Overview of Handling Payment Requests

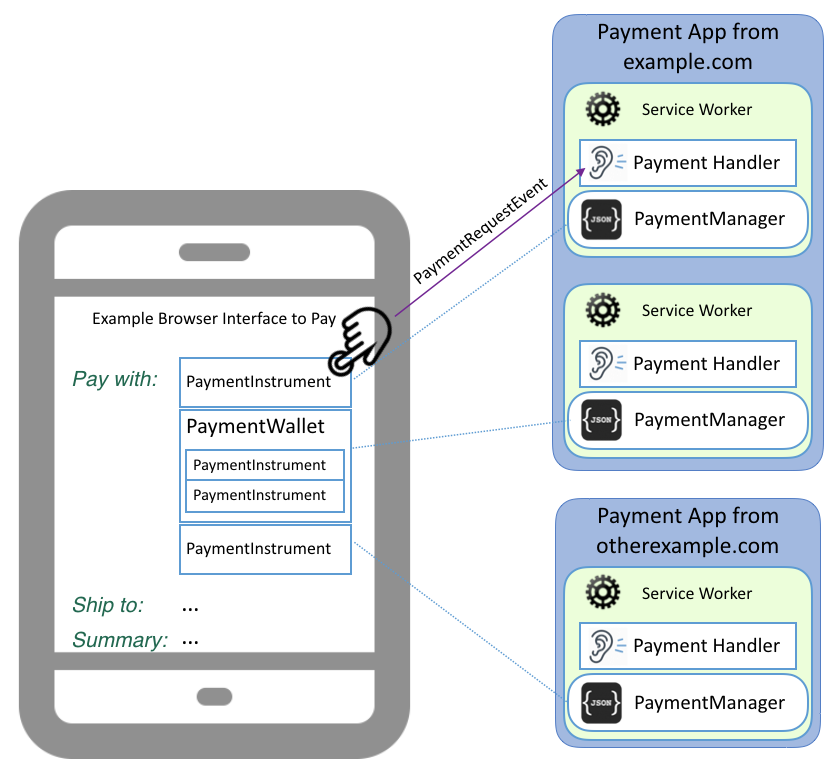

In this document we envision the following flow:

- An origin requests permission from the user to handle payment

requests for a set of supported payment methods. For example, a user

visiting a retail or bank site may be prompted to register a payment

handler from that origin. The origin establishes the scope of the

permission but the origin's capabilities may evolve without requiring

additional user consent. Although from a permissions perspective there

is a single Web app per origin, this specification provides mechanisms

to origins for flexible structuring and display of instruments and wallets.

-

Payment handlers are defined in service worker code.

- During service worker registration, the PaymentManager is

used to set:

- A list of enabled

payment methods.

- [Optionally] the conditions under which the handler supports a

given payment method; these capabilities play a role in

matching computations.

- Information for organizing the display and grouping of

instruments and

wallets supported by the

payment handler.

- When the merchant (or other payee) calls the

[[PAYMENT-REQUEST-API]] method show() (e.g., when the user

pushes a button on a checkout page), the user agent computes a list of

candidate payment handlers, comparing the payment methods accepted by

the merchant with those supported by registered payment handlers. For

payment methods that support additional filtering, merchant and payment

handler capabilities are compared as part of determining whether there

is a match.

- The user agent displays a set of choices to the user: the

registered instruments of

the candidate payment handlers. The user agent displays and groups

these choices according to information (labels and icons) provided at

registration or otherwise available from the Web app.

- When the user (the payer) selects an instrument, the user agent

fires a PaymentRequestEvent (cf. the user interaction

task source) in the service worker whose PaymentManager the

instrument was registered with. The PaymentRequestEvent includes

some information from the PaymentRequest (defined in

[[!PAYMENT-REQUEST-API]]) as well as additional information (e.g.,

origin and selected instrument).

- Once activated, the payment handler performs whatever steps are

necessary to handle the payment

request, and return an appropriate payment response to the

payee. If interaction with the user is necessary, the payment

handler can open a window for that purpose.

- The user agent receives a response asynchronously once the payment

handler has finished handling the request. The response becomes the

PaymentResponse (of [[!PAYMENT-REQUEST-API]]).

An origin may implement a payment app with more than one service worker

and therefore multiple payment handlers may be registered per

origin. The handler that is invoked is determined by the selection made

by the user of a payment

instrument. The service worker which stored the payment instrument with its

PaymentManager

is the one that will be invoked.

Registration

Extension to the ServiceWorkerRegistration interface

This specification extends the ServiceWorkerRegistration

interface with the addition of a paymentManager attribute.

partial interface ServiceWorkerRegistration {

readonly attribute PaymentManager paymentManager;

};

PaymentManager interface

interface PaymentManager {

[SameObject] readonly attribute PaymentInstruments instruments;

[SameObject] readonly attribute PaymentWallets wallets;

Promise<boolean> requestPermission();

};

The PaymentManager is used by payment apps to manage

their associated wallets, instruments and supported payment methods.

instruments attribute

This attribute allows manipulation of payment instruments

associated with a service worker (and therefore its payment

handler). To be a candidate payment handler, a handler must have at

least one registered payment instrument to present to the user.

That instrument needs to match the payment methods and required

capabilities specified by the payment request.

wallets attribute

This attribute is used to group payment instruments (e.g., to group

together "business account" payment instruments separately from

"personal account" payment instruments). Developers can provide a

name and icon for such a group. The use of this grouping mechanism

by payment handlers is completely optional. If payment handlers use

this grouping mechanism, then matching payment instruments that do

not appear in any groups should still be presented to users by the

user agent for selection.

Should the API support providing grouping information ("wallets")

to the user agent? What should requirements be on user agents to

display or provide for user interaction with this information?

requestPermission() method

The means for code requesting permission to handle payments is not

yet defined.

The user agent is NOT REQUIRED to prompt the user to grant

permission to the origin for each new supported payment method.

PaymentInstruments interface

interface PaymentInstruments {

Promise<boolean> delete(DOMString instrumentKey);

Promise<PaymentInstrument> get(DOMString instrumentKey);

Promise<sequence<DOMString>> keys();

Promise<boolean> has(DOMString instrumentKey);

Promise<void> set(DOMString instrumentKey, PaymentInstrument details);

Promise<void> clear();

};

The PaymentInstruments interface represents a collection of

payment instruments, each uniquely identified by an

instrumentKey. The instrumentKey identifier

will be passed to the payment handler to indicate the

PaymentInstrument selected by the user.

delete() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentInstrument with

a matching instrumentKey, remove it from the

collection and resolve p with true.

- Otherwise, resolve p with false.

- Return p

get() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentInstrument with

a matching instrumentKey, resolve p with

that PaymentInstrument.

- Otherwise, reject p with a DOMException

whose value is "NotFoundError".

- Return p

keys() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- Resolve p with a Sequence that

contains all the instrumentKeys for the

PaymentInstruments contained in the collection, in

original insertion order.

- Return p

has() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentInstrument with

a matching instrumentKey, resolve p with

true.

- Otherwise, resolve p with false.

- Return p

set() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentInstrument with

a matching instrumentKey, replace it with the

PaymentInstrument in details.

- Otherwise, insert the PaymentInstrument in

details as a new member of the collection and

associate it with the key instrumentKey.

- Resolve p.

- Return p

clear() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- Remove all PaymentInstruments from the collection

and resolve p.

- Return p

PaymentInstrument dictionary

dictionary PaymentInstrument {

required DOMString name;

sequence<ImageObjects> icons;

sequence<DOMString> enabledMethods;

object capabilities;

};

-

name member

-

The name member is a string that represents the label for

this PaymentInstrument as it is usually displayed to the

user.

-

icons member

-

The icons member is an array of image objects that can serve

as iconic representations of the payment instrument when presented

to the user for selection.

-

enabledMethods member

-

The enabledMethods member is a list of one or more

payment method identifiers of the payment methods

supported by this instrument.

-

capabilities member

-

The capabilities member is a list of payment-method-specific

capabilities that this payment handler is capable of supporting for

this instrument. For example, for the basic-card payment

method, this object will consist of an object with two fields: one

for supportedNetworks, and another for

supportedTypes.

ImageObjects comes from the Web App Manifest specification. Should we

reference the definition normatively, or make use of a simpler

structure here?

PaymentWallets interface

interface PaymentWallets {

Promise<boolean> delete(DOMString walletKey);

Promise<PaymentWallet> get(DOMString walletKey);

Promise<sequence<DOMString>> keys();

Promise<boolean> has(DOMString walletKey);

Promise<void> set(DOMString walletKey, PaymentWallet details);

Promise<void> clear();

};

Wallets are collections of payment instruments.

Where it appears, the walletKey argument is a unique

identifier for the wallet.

delete() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentWallet with a

matching walletKey, remove it from the collection

and resolve p with true.

- Otherwise, resolve p with false.

- Return p

get() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentWallet with a

matching walletKey, resolve p with that

PaymentWallet.

- Otherwise, reject p with a DOMException

whose value is "NotFoundError".

- Return p

keys() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- Resolve p with a sequence that contains all the

walletKeys for the PaymentWallets contained

in the collection, in original insertion order.

- Return p

has() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentWallet with a

matching walletKey, resolve p with

true.

- Otherwise, resolve p with false.

- Return p

set() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- If the collection contains a PaymentWallet with a

matching walletKey, replace it with the

PaymentWallet in details.

- Otherwise, insert the PaymentWallet in

details as a new member of the collection and

associate it with the key walletKey.

- Resolve p.

- Return p

clear() method

When called, this method executes the following steps:

- Let p be a new promise.

- Run the following steps in parallel:

- Remove all PaymentWallets from the collection and

resolve p.

- Return p

See issue 129.

PaymentWallet dictionary

dictionary PaymentWallet {

required DOMString name;

sequence<ImageObject> icons;

required sequence<DOMString> instrumentKeys;

};

-

name member

-

The name member is a string that represents the label for

this wallet as it is usually displayed to the user.

-

icons member

-

The icons member is an array of image objects that can serve

as iconic representations of the wallet when presented to the user

for selection.

-

instrumentKeys member

-

The instrumentKeys member is a list of one or more

instrumentKeys from PaymentManager.instruments,

indicating which PaymentInstrument objects are associated

with this Wallet, and should be displayed as being

"contained in" the wallet. While it is not generally good practice,

there is no restriction that prevents a PaymentInstrument

from appearing in more than one Wallet.

Origin and Instrument Display for Selection

After applying the matching algorithm defined in Payment Request API,

the user agent displays a list of instruments from matching payment

apps for the user to make a selection. This specification includes a

limited number of display requirements; most user experience details

are left to implementers.

Ordering of Payment Handlers

- The user agent MUST favor user-side

order preferences (based on user configuration or behavior) over

payee-side order preferences.

- The user agent MUST display matching

payment handlers in an order that corresponds to the order of

supported payment methods provided by the payee, except where

overridden by user-side order preferences.

- The user agent SHOULD allow the user

to configure the display of matching payment handlers to control the

ordering and define preselected defaults.

The second bullet above may be deleted based on PR API issue

481.

The following are examples of payment handler ordering:

- For a given Web site, display payment handlers in an order that

reflects usage patterns for the site (e.g., a frequently used payment

handler at the top, or the most recently used payment handler at the

top).

- Enable the user to set a preferred order for a given site or for

all sites.

- If the origin of the site being visited by the user matches the

origin of a payment handler, show the payment handler at the top of

the list.

The Working Group has discussed two types of merchant preferences

related to payment apps: (1) highlighting merchant-preferred payment

apps already registered by the user and (2) recommending payment apps

not yet registered by the user. The current draft of the

specification does not address either point, and the Working Group is

seeking feedback on the importance of these use cases. Note that for

the second capability, merchants can recommend payment apps through

other mechanisms such as links from their web sites.

Display of Instruments

The user agent MUST enable the user to

select any displayed instrument.

- At a minimum, we expect user agents to display an icon and label

for each matching origin to help the user make a selection.

- In some contexts (e.g., a desktop browser) it may be possible to

improve the user experience by offering additional detail to the

user. For example, if the user's "bank.com" origin knows about two

credit cards (thus, two potential responses to the same payment

method "basic-card"), the user agent could display each credit card's

brand and the last four digits of the card to remind the user which

cards the origin knows about.

In issue 98 there has been push-back to always requiring display of instruments

(e.g., on a mobile devices). User agents can incrementally show

instruments. Or user agents can return an empty instrumentKey and it

becomes the payment app's responsibility to display instruments to

the user.

Grouping of Instruments

At times, the same origin may wish to group instruments with greater

flexibility and granularity than merely "by origin." These use cases

include:

- White label wallets - one origin provides wallet services for

multiple vendors

- Multiple user profiles with a single provider (e.g., business

wallet vs personal wallet)

- Multiple instruments held with a single provider

A Wallet is a grouping of instruments for display

purposes.

To enable developers to build payment apps in a variety of ways, we

decouple the registration (and subsequent display) of instruments

from how payment handlers respond to a PaymentRequestEvent.

However, the user agent is responsible for communicating the user's

selection in the event.

Selection of Instruments

Users agents may wish to enable the user to select individual

displayed Instruments. The payment handler would receive information

about the selected Instrument and could take action, potentially

eliminating an extra click (first open the payment app then select

the Instrument).

Again related to issue 98: Should we require that, if displayed, individual instruments must be

selectable? Or should we allow flexibility that instruments may be

displayed, but selecting any one invokes all registered payment

handlers? One idea that has been suggested: the user agent (e.g., on

a mobile device) could first display the app-level icon/logo. Upon

selection, the user agent could display the Instruments in a submenu.

Invocation

Once the user has selected an Instrument, the user agent fires a

PaymentRequestEvent and uses the subsequent

PaymentAppResponse to create a PaymentReponse for

[[!PAYMENT-REQUEST-API]].

Payment Request API supports delegation of responsibility to manage an

abort to a payment app. There is a proposal to add a

paymentRequestAborted event to the Payment Handler interface. The event

will have a respondWith method that takes a boolean parameter

indicating if the paymentRequest has been successfully aborted.

This specification extends the ServiceWorkerGlobalScope

interface.

partial interface ServiceWorkerGlobalScope {

attribute EventHandler onpaymentrequest;

};

The PaymentRequestEvent

The PaymentRequestEvent represents a received

PaymentRequest.

[Exposed=ServiceWorker]

interface PaymentRequestEvent : ExtendableEvent {

readonly attribute DOMString topLevelOrigin;

readonly attribute DOMString paymentRequestOrigin;

readonly attribute DOMString paymentRequestId;

readonly attribute FrozenArray<PaymentMethodData> methodData;

readonly attribute PaymentItem total;

readonly attribute FrozenArray<PaymentDetailsModifier> modifiers;

readonly attribute DOMString instrumentKey;

Promise<WindowClient> openWindow(USVString url);

void respondWith(Promise<PaymentAppResponse>appResponse);

};

topLevelOrigin attribute

This attribute is a string that indicates the origin of the top level payee web page.

The string MUST be formatted according to the "Unicode Serialization of an Origin"

algorithm defined in section 6.1 of [[!RFC6454]].

paymentRequestOrigin attribute

This attribute is a string that indicates the origin where a PaymentRequest was

initialized. When a PaymentRequest is initialized in the

topLevelOrigin, the attributes have the same value,

otherwise the attributes have different values. For example, when a

PaymentRequest is initialized within an iframe from an

origin other than topLevelOrigin, the value of this

attribute is the origin of the iframe. The string MUST be formatted

according to the "Unicode

Serialization of an Origin" algorithm defined in section 6.1 of

[[!RFC6454]].

openWindow() method

This method is used by the payment handler to show a window to the

user. When called, it runs the open window algorithm.

respondWith() method

This method is used by the payment handler to provide a

PaymentAppResponse when the payment successfully completes.

Should payment apps receive user data stored in the user agent upon

explicit consent from the user? The payment app could request

permission either at installation or when the payment app is first

invoked.

For DOM events compatibility, need to add a constructor, and the

members of the corresponding dictionary need to match the attributes

of the event.

MethodData Population Algorithm

To initialize the value of the methodData, the user agent

MUST perform the following steps or their equivalent:

- Set registeredMethods to an empty set.

- For each PaymentInstrument instrument in the

payment handler's PaymentManager.instruments,

add all entries in instrument.enabledMethods to

registeredMethods.

- Create a new empty Sequence.

- Set dataList to the newly created Sequence.

- For each item in

PaymentRequest@[[\methodData]] in the

corresponding payment request, perform the following steps:

- Set inData to the item under consideration.

- Set commonMethods to the set intersection of

inData.supportedMethods and

registeredMethods.

- If commonMethods is empty, skip the remaining

substeps and move on to the next item (if any).

- Create a new PaymentMethodData object.

- Set outData to the newly created

PaymentMethodData.

- Set outData.supportedMethods to a list

containing the members of commonMethods.

- Set outData.data to a structured clone of

inData.data.

- Append outData to dataList.

- Set methodData to dataList.

Internal Slots

Instances of PaymentRequestEvent are created with the internal

slots in the following table:

|

Internal Slot

|

Default Value

|

Description (non-normative)

|

|

[[\windowClient]]

|

null

|

The currently active WindowClient. This is set if a

payment handler is currently showing a window to the user.

Otherwise, it is null.

|

Windows

An invoked payment handler may or may not need to display information

about itself or request user input. Some examples of potential payment

handler displays include:

- The payment handler opens a window for the user to provide an

authorization code.

- The payment handler opens a window that makes it easy for the user

to confirm payment using default information for that site provided

through previous user configuration.

- When first selected to pay in a given session, the payment handler

opens a window. For subsequent payments in the same session, the

payment handler (through configuration) performs its duties without

opening a window or requiring user interaction.

A payment handler that requires visual display and user

interaction, may call openWindow() to display a page to the user.

Since user agents know that this method is connected to the

PaymentRequestEvent, they SHOULD render the window in a way that

is consistent with the flow and not confusing to the user. The

resulting window client is bound to the tab/window that initiated the

PaymentRequest. A single payment handler SHOULD NOT be

allowed to open more than one client window using this method.

This example shows how to write a service worker that listens to the

PaymentRequestEvent. When a PaymentRequestEvent is

received, the service worker opens a window to interact with the

user.

self.addEventListener('paymentrequest', function(e) {

e.respondWith(new Promise(function(resolve, reject) {

self.addEventListener('message', listener = function(e) {

self.removeEventListener('message', listener);

if (e.data.hasOwnProperty('name')) {

reject(e.data);

} else {

resolve(e.data);

}

});

e.openWindow("https://www.example.com/bobpay/pay")

.then(function(windowClient) {

windowClient.postMessage(e.data);

})

.catch(function(err) {

reject(err);

});

}));

});

The Web Payments Working Group plans to revisit these two examples.

Using the simple scheme described above, a trivial HTML page that is

loaded into the payment handler window to implement the

basic card scheme might look like the following:

<form id="form">

<table>

<tr><th>Cardholder Name:</th><td><input name="cardholderName"></td></tr>

<tr><th>Card Number:</th><td><input name="cardNumber"></td></tr>

<tr><th>Expiration Month:</th><td><input name="expiryMonth"></td></tr>

<tr><th>Expiration Year:</th><td><input name="expiryYear"></td></tr>

<tr><th>Security Code:</th><td><input name="cardSecurityCode"></td></tr>

<tr><th></th><td><input type="submit" value="Pay"></td></tr>

</table>

</form>

<script>

window.addEventListener("message", function(e) {

var form = document.getElementById("form");

/* Note: message sent from payment app is available in e.data */

form.onsubmit = function() {

/* See https://w3c.github.io/webpayments-methods-card/#basiccardresponse */

var basicCardResponse = {};

[ "cardholderName", "cardNumber","expiryMonth","expiryYear","cardSecurityCode"]

.forEach(function(field) {

basicCardResponse[field] = form.elements[field].value;

});

/* See https://w3c.github.io/webpayments-payment-apps-api/#sec-app-response */

var paymentAppResponse = {

methodName: "basic-card",

details: details

};

e.source.postMessage(paymentAppResponse);

window.close();

}

});

</script>

Response

PaymentAppResponse dictionary

The PaymentAppResponse is conveyed using the following dictionary:

dictionary PaymentAppResponse {

DOMString methodName;

object details;

};

details attribute

A JSON-serializable object that provides a payment

method specific message used by the merchant to process the

transaction and determine successful fund transfer.

The user agent receives a successful response from the payment

handler through resolution of the Promise provided to the

respondWith()

function of the corresponding PaymentRequestEvent

dictionary. The application is expected to resolve the Promise with

a PaymentAppResponse instance containing the payment

response. In case of user cancellation or error, the application

may signal failure by rejecting the Promise.

If the Promise is rejected, the user agent MUST run the

payment app failure algorithm. The exact details of this

algorithm are left to implementers. Acceptable behaviors include,

but are not limited to:

- Letting the user try again, with the same payment handler or

with a different one.

- Rejecting the Promise that was created by PaymentRequest.show().

Extention to User Accepts the Payment Request Algorithm

If the Promise is successfully resolved, the user agent MUST run the

user accepts the payment request algorithm as defined in

[[!PAYMENT-REQUEST-API]], replacing steps 6 and 7 with these steps or

their equivalent:

- Set appResponse to the PaymentAppResponse

instance used to resolve the PaymentRequestEvent.respondWith() Promise.

- If appResponse.methodName is not present or not

set to one of the values from

PaymentRequestEvent.methodData,

run the payment app failure algorithm and terminate these

steps.

- Create a structured clone of

appResponse.methodName and assign it to

response.methodName.

- If appResponse.details is not present, run

the payment app failure algorithm and terminate these steps.

- Create a structured clone of

appResponse.details and assign it to

response.details.

The following example shows how to respond to a payment request:

paymentRequestEvent.respondWith(new Promise(function(accept,reject) {

/* ... processing may occur here ... */

accept({

methodName: "basic-card",

details: {

cardHolderName: "John Smith",

cardNumber: "1232343451234",

expiryMonth: "12",

expiryYear : "2020",

cardSecurityCode: "123"

}

});

});

[[!PAYMENT-REQUEST-API]] defines an ID that parties in the

ecosystem (including payment app providers and payees) may use for

reconciliation after network or other failures.